Supplemental details are awarded to apps that provide pathways to budgeting and saving, which can be functions which can help stop a person from habitually reborrowing. We weigh these components based upon our assessment of which are the most important for individuals And the way they influence individuals’ encounters.

Yes, cash advances do have caveats. For those who initiate a cash advance by way of your bank card, you’ll fork out greater APR expenses than you'd probably for traditional charge card balances.

Checking account guideBest checking accountsBest totally free checking accountsBest on line Look at accountsChecking account solutions

Keep in mind: If you don’t have to have your cash a similar working day, APRs can be as little as 0% considering the fact that some suppliers, like MoneyLion or EarnIn, don’t charge month to month charges. However, if you see your self using out frequent exact-day cash advances, It can save you income by picking an application with very low instantaneous transfer charges.

Present day home loan rates30 calendar year property finance loan rates5-yr ARM rates3-year ARM ratesFHA home finance loan ratesVA mortgage loan ratesBest home finance loan lenders

Although some car or truck mortgage lenders might utilize the FICO automobile score to examine an applicant’s eligibility, they could also choose to use The essential FICO rating or their VantageScore.

Instacash is definitely an optional assistance offered by MoneyLion. Your offered Instacash Advance limit might be exhibited to you from the MoneyLion cell app and could alter from time to time.

Cash advance apps generally make it possible for end users to access cash advances without the need of credit rating checks, curiosity, or late service fees, but may possibly come with every month membership costs to obtain their income management instruments, investing accounts, or simply to have your account open up in the slightest degree.

Any time you use Instacash, the amount you’ve taken out is routinely deducted from a account around the repayment date as determined by your fork out cycle – without having interest. You might take A further Instacash when you repay your previous Instacash providing you retain your eligibility.

At the same time, a lot of people may locate this sort of arrangement preferable to creditors who don’t treatment exactly how much you rack up in expenses. You’ll also acquire your resources rapidly, commonly in just two-3 enterprise days at most.

However, this does not influence our evaluations. Our viewpoints are our personal. Here is an index of our partners and This is how we earn money.

Could bring about an overdraft cost: Most apps call for use of your checking account to withdraw income when it’s because of. Some organizations say they try to stay away from triggering an overdraft but don’t guarantee it. The exception is Empower, which is able to refund, upon ask for, overdraft expenses it will cause.

Cash advance apps are finest made use of if you need only a little amount of money that you already know your next paycheck will include—and when you could find an app that doesn’t charge large costs for external or expedited transfers.

Featuring consumers the opportunity to cash out approximately $one hundred per operate day (around a highest of $750 per pay interval) easy cash advance apps as an advance, EarnIn has the best cash advance maximums on our listing by a long shot. We also adore that—as opposed to charging a regular monthly payment or instantly enrolling you inside a revenue management application that does—EarnIn relies on an optional (and refundable) tipping system to get paid income on its cash advance merchandise.

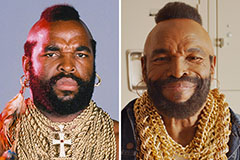

Mr. T Then & Now!

Mr. T Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Shannon Elizabeth Then & Now!

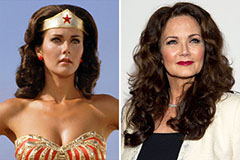

Shannon Elizabeth Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!